Mark Handley/University College London

High above the clouds, where the International Space Station quietly orbits the Earth, and the space junk freely roams, is a region of space known as the Low Earth Orbit (LEO). Strangely enough, aside from being a garbage dump, Low Earth Orbit has also been prioritized by the entrepreneur billionaires Elon Musk and Jeff Bezos following their brilliant success of SpaceX and Amazon.

With the advancement of the Low Earth Orbit telecommunication industry, let’s explore 5 reasons why satellites in Low Earth Orbit have begun paving the way for humanity’s future.

- Geostationary Orbit vs. Fibre Optic vs. Low Orbit Telecommunication Satellites

- Let’s Talk Business

- The Solution to the Digital Divide

- Starlink and their Promises

- Project Kuiper and Amazon

1. Geostationary Orbit vs. Fibre Optic vs. Low Orbit Telecommunication Satellites

The telecommunication industry consists of companies that service information transmissions through wire, radio, optical, or other electromagnetic systems. Fiber optics, geostationary, and now low orbit satellites are a part of this ever-growing sector.

A geostationary orbit, otherwise known as geosynchronous equatorial orbit (GEO), is a circular orbit that lies on the same plane as the equator. Satellites of this orbit are located above the equatorial plane at an altitude of ~35680 kilometers, and it appears to be located at a fixed point in the sky when viewed from the Earth’s surface.

GEO satellites have dominated the commercial and government communication satellite systems for telecommunication services since the early 1960s. The GEO satellite utilizes electromagnetic waves for transmission, which has a speed of 3 · 108 m/s in open space and a propagation time of ~270 ms one way and ~540 ms round trip between the satellite and an Earth terminal.

Fiber optics did not become popular until the commercial availability of optical-amplification systems.

During the 1990s, the telecommunications industry began laying intercity and transoceanic fiber communication lines. And by 2002, a fiber optics network of 250,000 kilometers with a data capacity of 2.56 Tb/s was completed.

The fiber optics cable contains strands of glass fibers inside an insulated casing, and it is designed to be high performance for long-distance data networking and telecommunications. Pulses of infrared light are sent through the glass fibers to transmit the intended information.

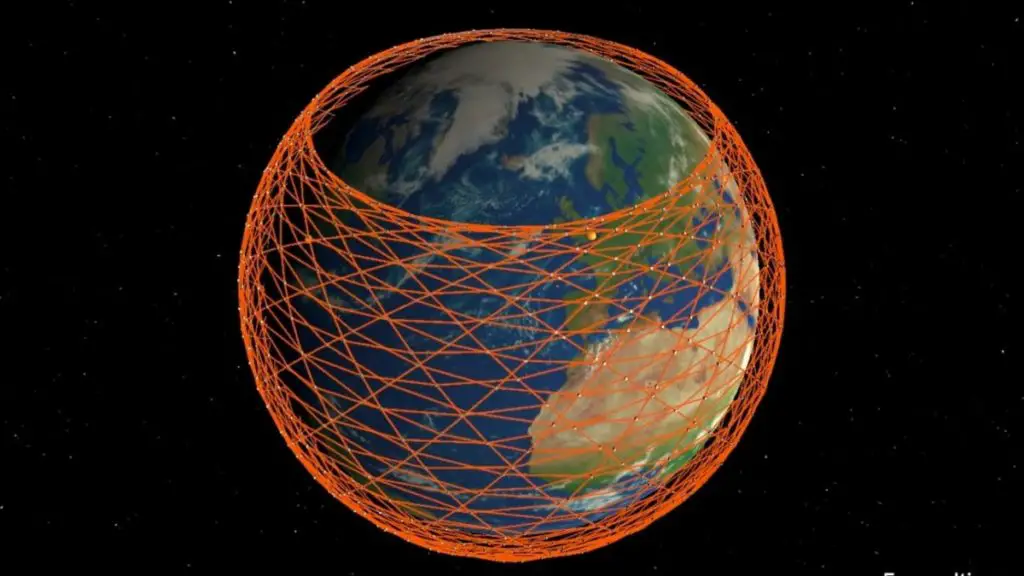

Low Earth Orbit (LEO) satellites orbits at an altitude of 760 to 960 kilometers above the Earth’s surface. This distance will only allow the satellites to see a relatively small portion of the Earth at any instant, which requires the satellites to constantly be in motion and travel at high speeds (with an orbit period of ~100 minutes).

To achieve worldwide coverage, large numbers of LEO satellites will be required to form constellations in near-polar orbit to maintain path continuity, as signal links must be frequently handed off from one to the other.

Image by Marco Langbroek/SatTrackCam

The feasibility of LEO satellites stems from their distance to Earth and their short propagation delay. The speed of electromagnetic waves of radio signals is assumed to propagate in free space at the speed of light, while all terrestrial connections via fiber optic cable only travel at 2/3 the speed of light. And compared to GEO satellites, it is cheaper to launch smaller satellites into low earth orbit.

The LEO satellite network’s crosslink architecture has also been assumed to provide connection speeds faster than fiber optics. Under optimal conditions, a call from Washington DC to London via fiber optics (6080 km) would result in a terrestrial path delay of 61 ms. Simultaneously, the LEO satellite system, with a two satellite path connection (7520 km) would only result in a two-way propagation delay of 50 ms.

Comparably, both aforementioned methods of transmission outperform GEO satellites in terms of propagation delay. This is important for consumer experience as tests performed on humans indicate that the time it takes to react to visual or aural stimulus ranges from 200 to 300 ms. Human perception of delay will become noticeable once the propagation time surpasses these values.

However, the most praised aspect of the LEO constellations would have to be its intended worldwide coverage. It would provide high-speed broadband connection to any location on Earth with no access to such amenities, whether it be rural communities, the middle of the Pacific, or the scorching sands of the Sahara desert.

2. Let’s Talk Business

The emergence of the Low Earth Orbit Satellite industry provides new business opportunities for aspiring and established entrepreneurs. Such new business models allow new revenue sources that would have otherwise not been available with limited connectivity provided by traditional communication companies.

The old business model followed revenues from service fees for bandwidth and broadband access, and consumers were often charged based on usage. But due to the low demand for internet access in the 1990s, this model was not viable for the concept of LEO satellite constellations.

This is not to say it’s no longer risky to charge consumers based on usage time now. Even with increased demand, the market has just unfortunately adapted to a preference for unlimited access and usage.

New options for generating revenue with increased connectivity include:

- In House Content Development

- New Online Distribution Channels for Advertisements

- Availability of Bundled Services

Increased connectivity has allowed traditional connectivity players like AT&T and Time Warner, and companies that started as distributors like Amazon and Netflix to bring content development and distribution in-house. This gives companies new opportunities to obtain a new revenue stream that is not solely dependent on access pricing, such as producing original content.

The current reality is that online advertisements generate more revenue than print or television ads. With increased connectivity leading to an increase in online distribution channels, communication companies can supplement their existing revenues by offering spaces for paid content and charging advertisers for premium ad placement.

New connectivity options also allow companies to offer one or more elements for free or below cost to increase revenue elsewhere (ex. Amazon Prime and Free Shipping). Social and communication networks can also offer bundled services that include free connectivity, which would drive up revenue for ad placement of the social platforms and platform services usage with increased user time on site.

Nonetheless, even with new revenue streams, most companies have turned their focus on acquiring new customers and building ecosystem control. Their goal is to establish as early leaders with prices so low that might even eliminate the possibility of profits. For a loss on early profits, this would create a foundation that enables their long-term success. Increasing scale and acquiring a critical mass of users ultimately allow these companies to shift their focus to making money from their established network.

The viability of the aforementioned business model/strategy to succeed has become apparent due to increased funding availability. Funding availability in this sense doesn’t only apply to private investors but also speaks on the available cash flow of companies now compared to the 1990s.

This all becomes relevant when considering LEO satellite constellations, as estimates for deploying an operational system range from $5 to $10 billion. The annual operating cost for replacing satellites ranges from $1 to $2 billion, and ground sites and antennas will also require high operating costs. Unfortunately, everything requires a substantial upfront investment.

Companies with the available cash flow to take on such projects outright include Amazon, Facebook, and Apple, etc. Investment firms have also had more than $2.3 trillion on hand to spend in late 2019. Funding and actual investment for such communication systems and other space projects could increase if more investors see potential in the market. But one thing is for sure, the cost to deploy such constellations and their operation cost is no longer a deal-breaker for investors.

3. The Solution to the Digital Divide

The Digital Divide is the gap between demographic regions for access to modern information and communication technology. Currently in America, and many other parts of the world, millions and billions go without access to computers and the internet, especially in the rural regions and communities.

The FCC reports 22.3% of Americans in rural areas to lack access to broadband internet, and other surveys bring the numbers up to 37%. Within tribal lands, this statistic jump by another 5%. Low-income citizens also lack access to such technologies as they cannot afford the high rates, or service providers simply skip over low-income neighborhoods when building infrastructure.

As more of the world is moving online, such as education, jobs, healthcare, and entertainment, the disparity in internet access is causing the digital divide to grow even wider.

Sounds pretty bad right? But thankfully, there is a solution.

Low Earth Orbit satellite constellations will offer faster speeds and more data to rural customers at more competitive rates. With increased coverage, signal blockage also rarely occurs for an LEO constellation as the satellites are constantly moving.

In December 2020, SpaceX took home $886 million in federal funding to provide broadband service to more than 600,000 locations across America.

The viability of LEO satellites is further commented on by Carl Russo, the CEO of the telecommunication company Calix, who said, “for very rural places that have no access to other solutions, satellite internet makes sense.” However, “for less isolated areas, satellites cannot offer what fiber optics and other wireless technology like 5G can.” As such, he describes LEO satellite internet as “a complementary system, not a competitive technology.”

The National Research Council (NRC) of Canada has also stated the importance of satellite over traditional fiber optics for rural and remote areas. But to provide the same data rates, these LEO satellites must utilize optical signals (ex. lasers) instead of the current radio bands, which are considerably slower. Although, clouds on a story day or even normal fluctuations in air density might block or disrupt optical signals.

LEO satellite internet’s feasibility and effectiveness will continue to increase as more problems begin to get solved. And it will no doubt play an imperative role in closing the Digital Divide.

4. Starlink and their Promises

Starlink is an LEO satellite constellation being constructed by SpaceX with the grand goal of providing internet access to everyone in the world. With an initial goal of 12,000 satellites orbiting the Earth, SpaceX has applied to launch another 30,000 for a total of 42,000 Starlink satellites.

In its beta phase, Starlink currently has 1,378 satellites in orbit, which has only been able to give Starlink global reach, not global connectivity.

Starlink satellites provide broadband connectivity by connecting to a ground terminal with built-in motors that can self-adjust for optimal angles to view the sky. Elon Musk has termed this terminal to be a “round UFO on a stick.”

Officially, SpaceX boasts Starlink satellites to be “over 60 times closer to Earth than traditional satellites, resulting in lower latency and the ability to support services typically not possible with traditional satellite internet.” This high-speed, low latency broadband internet will be able to provide “data speeds of 150 MB/s with a latency of 20-40 ms.”

Surprisingly, SpaceX might not have been far off as independent third-parties have been showing performance numbers at a top speed of 103 MB/s and a latency of 18 ms.

As Starlink is ideal for rural and remote communities where access to high-speed broadband internet has been unreliable or completely unavailable, SpaceX has applied for the FCC $16 million Rural Digital Opportunity Fund (RDOF), whose plan was to bring broadband with download speeds of at least 25 MB/s to six million home and business without access to high-speed internet.

With servicing rural America as their starting point, the final goal of Starlink is to connect the whole world.

By Official SpaceX Photos – Starlink Mission, CC0, https://commons.wikimedia.org/w/index.php?curid=79191427

This goal is slowly coming into view as SpaceX is capable of sending 40-60 satellites into orbit per launch. With their orbits placed in sets of complementary orbital planes, the completion of the Starlink constellation will allow at least one satellite to be seen anytime, from anywhere on Earth.

Currently, Starlink leads the way in the LEO satellite internet sector. And for Elon Musk, this might only be a small step towards solving the problem of creating an Earth-like environment on Mars.

5. Project Kuiper and Amazon

Project Kuiper is an initiative by Jeff Bezos and Amazon to launch a constellation of LEO satellites that can provide low latency and high-speed broadband connectivity to unserved and underserved communities worldwide.

That goal might currently be far-fetched as FCC has only granted Amazon approval in Spring 2020 to deploy and operate a constellation of 3,236 satellites. This, however, was not enough to sway their confidence, as Amazon has stated they will invest more than $10 billion in Project Kuiper.

The ground-based terminals proposed for Project Kuiper is a phased array system that will structure antenna arrays to overlay rather than be placed next to each other. This design reduces the weight and size of the entire terminal, decreasing the production cost and allowing operation in a frequency that delivers higher bandwidth.

In the grand scheme of things, providing worldwide broadband coverage probably isn’t Amazon’s end goal. Experts suggest the real play here is the ability for Amazon to vertically integrate the Kuiper constellation into the rest of the Amazon ecosystem.

Global broadband access can be implemented as part of Amazon Web Services, which already offers resources for cloud computing, machine learning, data analytics, and more.

Project Kuiper can be thought of as the middleman for getting data into AWS, which can then be distributed to end-users through the cloud. As a result, Kuiper will allow the expansion of cloud computing into the final frontier.

Like Starlink and SpaceX, satellites for Project Kuiper can also be launched via rockets at Blue Origin, another one of Jeff Bezo’s ventures into space focused on reusable launch vehicles.

Although Project Kuiper is currently lagging behind Starlink in terms of development and availability, Amazon has access to funds that can back up their initial investment to get everything right the first time. Once in orbit, the potential impact Kuiper might have on the world will be paramount, all thanks to the already established Amazon ecosystem.

Clint Crosier, the current head of Amazon’s Aerospace and Satellite solutions unit pronounces:

AWS is here in the space business to stay … I will unveil to you our new motto for the aerospace and satellite team: ‘To the stars through the cloud.’

References

- Vaughan-Nichols, S. J. (2020, September 21). Starlink starts to deliver on its satellite internet promise. ZDNet. https://www.zdnet.com/article/starlink-starts-to-deliver-on-its-satellite-internet-promise/

- Mack, E. (2021, February 16). How SpaceX Starlink broadband will envelop Earth and transform the sky. CNET. https://www.cnet.com/features/how-spacex-starlink-broadband-service-will-envelop-earth-transform-the-sky/

- Campanella, S. J., & Kirkwood, T. J. (1995). Faster than Fiber: Advantages and Challenges of Leo Communications Satellite Systems. Center for Satellite and Hybrid Communication Networks. https://drum.lib.umd.edu/bitstream/handle/1903/5710/TR_95-21.pdf?sequence=1&isAllowed=y

- Berlocher, G. (2009, September 1). Minimizing Latency in Satellite Networks. Via Satellite. https://www.satellitetoday.com/telecom/2009/09/01/minimizing-latency-in-satellite-networks/

- Cooke, K. (2021, March 10). Low-Earth Orbit: The Solution to the Digital Divide Could Be Closer than You. . . SatelliteInternet.Com. https://www.satelliteinternet.com/resources/what-is-low-earth-orbit-satellite-internet/

- Estes, A. C. (2020, September 26). Elon Musk and SpaceX launch Starlink satellite broadband internet amid pandemic. Vox. https://www.vox.com/recode/2020/9/26/21457530/elon-musk-spacex-starlink-satellite-broadband-amazon-project-kuiper-viasat

- Daehnick, C., Klinghoffer, I., Maritz, B., & Wiseman, B. (2020, May 4). Large LEO satellite constellations: Will it be different this time? McKinsey & Company. https://www.mckinsey.com/industries/aerospace-and-defense/our-insights/large-leo-satellite-constellations-will-it-be-different-this-time#

- Choi, M. (2020, September 9). Low-Earth Orbit Satellites: Risk and Reward. National Technical Systems. https://www.nts.com/ntsblog/low-earth-orbit-satellites-risk-and-reward/

- The space internet race is dawning. Here’s what to expect. (2019, July 24). World Economic Forum. https://www.weforum.org/agenda/2019/07/the-space-internet-race-is-dawning-here-s-what-to-expect/

- Satellites 101: LEO vs. GEO. (2018, September 9). Iridium Satellite Communications. https://www.iridium.com/blog/2018/09/11/satellites-101-leo-vs-geo/

- Satellite communications bridge the digital divide between urban and remote areas. (2021, February 10). NRC Canada. https://nrc.canada.ca/en/stories/satellite-communications-bridge-digital-divide-between-urban-remote-areas

- Boyle, A. (2020, December 17). Project Kuiper plus AWS: How Amazon’s cloud and satellite internet ventures mesh. GeekWire. https://www.geekwire.com/2020/project-kuiper-plus-aws-amazons-cloud-satellite-internet-ventures-mesh/

- Amazon’s Project Kuiper is More Than the Company’s Response to SpaceX. (2020, August 17). IEEE Spectrum: Technology, Engineering, and Science News. https://spectrum.ieee.org/tech-talk/aerospace/satellites/amazons-project-kuiper-is-more-than-the-companys-response-to-spacex

- Wikipedia contributors. (2021, April 4). Fiber-optic communication. Wikipedia. https://en.wikipedia.org/wiki/Fiber-optic_communication

- Wikipedia contributors. (2021b, April 10). Starlink. Wikipedia. https://en.wikipedia.org/wiki/Starlink